5 Things That Make South Orange, NJ So Liveable and Likeable

07/31/2015

From New York City to a Northern NJ Home: It Could Be For You!

09/30/2015Homeownership is part of the quintessential American dream, but for someone who has always rented, it brings a whole new set of responsibilities. There are mortgage payments, home repairs and winter walkways to shovel. There is lawn maintenance in the spring and gutters to clean in fall. For renters, the leap to homeownership can seem daunting; and if it doesn’t work out, they will grapple with a home sale as opposed to just forgoing a lease renewal.

Yet in 2014, over 67% of Americans chose to be homeowners. From financial incentives to quality of life, here are 5 reasons to buy a home instead of rent:

1. Rental homes can restrict pets

If you love pets, especially dogs, you’re not alone. According to the World Animal Foundation, 49.5% of US households own at least one dog. Cat owners are just as prevalent and usually own more than one feline. Pets, large breed dogs in particular, can drastically limit home rental options. Some rental contracts that do permit dogs will limit the breed and size. Landlords often insist on an additional pet deposit or pet insurance. If you find yourself in need of a backyard fence, as a renter you are in no position to add one.

2. Mortgage interest deductions incentivize homeownership

In the United States, mortgage interest payments and first year origination fees are tax deductible; rental payments are not. If it makes sense for you to itemize deductions and their sum exceeds the standard deduction on your return, mortgage interest deductions can be a big benefit to home ownership. Mortgages typically have larger interest payments in the early years, so the mortgage interest deduction is even more beneficial in the initial years of the mortgage term.

3. Fixed rate mortgage payments provide cash flow visibility

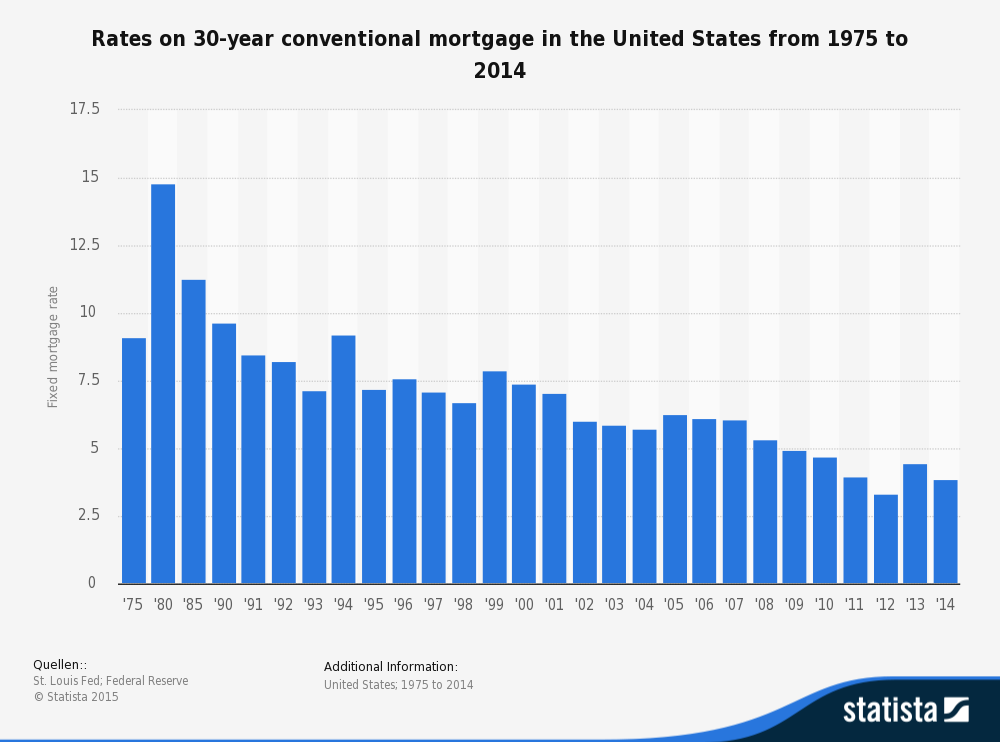

The 30-year conventional fixed rate mortgage rates are still near the 2012 lows. As a homeowner, you can lock in a fixed rate mortgage rate at low levels and have full visibility of your monthly payments for years to come. Alternatively, one of the most frustrating aspects to renting a home is that you cannot control the change in rent each time the rental term is up. Monthly rental payments typically rise over the long term, and if you are unhappy with the new terms, your only choice is to let the rental agreement expire and move.

4. Home improvements enhance the value of your investment

Renters have no incentive to do anything beyond basic home repairs because they don’t own the house. Without the owner’s permission, a renter would be prohibited from doing a permanent capital improvement on the property anyway. As a homeowner, there are powerful incentives to do home improvements. Not only can home improvements increase the overall value of a home, they can also improve the quality of life for those living in the house. When it comes time to sell the house, capital improvements can be added to the cost basis of the home and reduce the calculated capital gain.

5. Capital gains treatment is favorable to profitable home sales

US tax laws are advantageous to homeowners that sell their primary residence for a profit although there are ownership and use tests as well as certain exclusions. In general, if you qualify and file an individual return, you can exclude up to $250,000 in gains from your income or $500,000 if you file a joint return. The treatment of capital gains from the sale of a home is a compelling incentive to own a home over the long term.

If you are considering making the leap from renting to homeownership, I would love to assist you. There are so many reasons to buy a home, but the decision is a life changing one, and you are sure to have a list of questions. With 18 years of real estate experience, I can help. Call Victoria Carter at (973) 220-3050 or email victoria@victoriacarter.com.